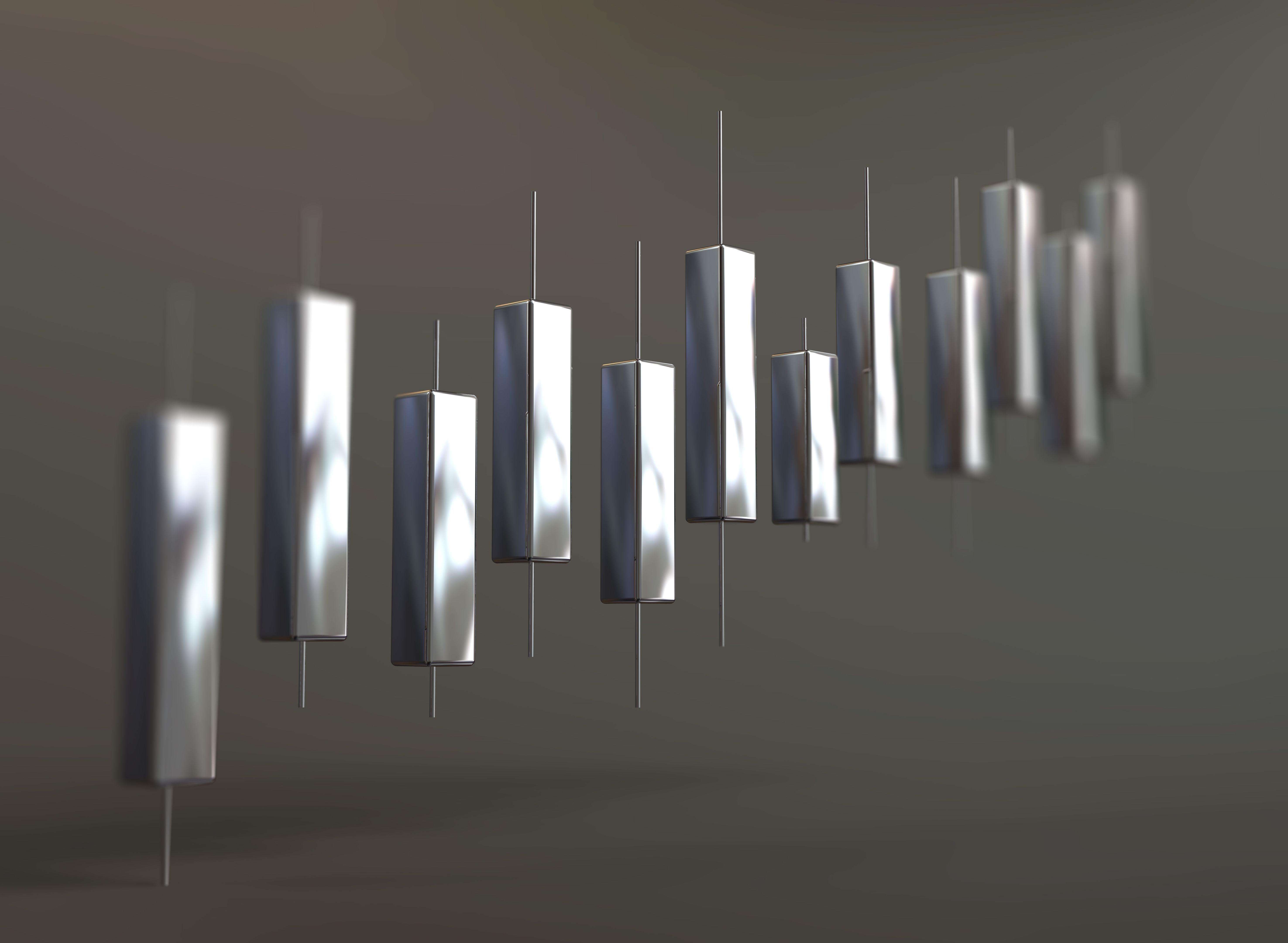

Silver: A Reliable Shield in a Volatile Economy

The Historical Significance of Silver

Throughout history, silver has played a crucial role in global economies. Its use in trade dates back thousands of years, serving as a standard of wealth and a medium of exchange. The stability and reliability of silver have made it a preferred choice for investors looking to safeguard their assets during times of economic uncertainty.

Silver's intrinsic value, derived from its scarcity and desirability, has ensured its continued prominence. Unlike fiat currencies, which can be affected by inflation and governmental policies, silver maintains its worth over time, offering a hedge against economic instability.

The Growing Demand for Silver

The demand for silver has been steadily increasing, driven by its diverse applications in various industries. From electronics to solar panels and medical devices, silver's unique properties make it indispensable. This growing demand bolsters its value, providing an additional layer of security for investors.

Investors recognize silver's potential as a tangible asset that can be relied upon during market fluctuations. As the global economy faces uncertainties, the demand for stable and reliable assets like silver is expected to rise.

Silver vs. Gold: A Comparative Analysis

While gold often takes the spotlight as a safe-haven asset, silver offers a compelling alternative. One of the primary advantages of silver is its affordability. This makes it accessible to a wider range of investors, allowing them to diversify their portfolios without the need for substantial capital.

Additionally, silver's industrial applications mean that its demand is not solely reliant on investment purposes. This dual demand helps stabilize its price, making it less volatile compared to gold. As a result, silver can serve as a more reliable shield in a volatile economy.

Investing in Silver: Options and Strategies

Investors have several options when it comes to incorporating silver into their portfolios. These include purchasing physical silver, such as coins and bars, or investing in exchange-traded funds (ETFs) and mining stocks. Each option has its own set of advantages and risks, allowing investors to tailor their strategies to their specific needs.

For those seeking a direct approach, physical silver offers the satisfaction of owning a tangible asset. On the other hand, ETFs and stocks provide liquidity and ease of trading, making them suitable for investors looking to capitalize on market movements.

The Future Outlook for Silver

As technological advancements continue to evolve, the demand for silver is likely to grow. Emerging technologies, such as electric vehicles and renewable energy, heavily rely on silver due to its excellent conductivity and reflectivity. This ongoing demand will play a significant role in shaping silver's future trajectory.

In conclusion, silver remains a reliable shield in a volatile economy. Its historical significance, growing industrial demand, and relative affordability make it an attractive option for investors seeking stability and diversification. As global uncertainties persist, silver's role as a safe-haven asset is more relevant than ever.